The Future of Deep Tech Investing

We invest in and build alongside hard tech innovators, providing the essential combination of capital and physical capacity to turn ambitious designs into market-ready products.

Subutai Capital is a new kind of venture capital firm, built to solve the unique challenges of hard tech companies. We bridge the gap between brilliant ideas and market-ready products by providing more than just funding -

We provide the physical infrastructure and operational expertise to support manufacturing processes. Our integrated model is designed to unlock venture-scale returns for investors and accelerate success for founders.

Subutai’s vision is simple yet powerful: we are building an investment and manufacturing platform to make the most valuable tech companies of the next decade possible.

For Founders: The Missing Link for Hard Tech

Hard tech founders face a "valley of death" — the immense challenge of scaling from prototype to production. This long, capital-intensive process often leads to significant dilution, diverting focus and resources away from core innovation.

Subutai is your strategic partner, combining our investment with hands-on manufacturing support, we empower you to:

- Reduce Dilution: Achieve critical development milestones with less external capital, allowing you to retain a larger stake in your company.

- Accelerate Timelines: Our advanced manufacturing facility and forward-deployed engineers streamline the journey from concept to commercialization.

- Focus on Innovation: We handle the complex, undifferentiated aspects of manufacturing, freeing you to focus on your breakthrough technology and market expansion.

- Build a Competitive Moat: We help you design for manufacturability, ensuring your product is scalable and cost-effective from day one.

For Investors: Unlocking Superior Returns

Investing in early-stage deep tech carries inherent risks—from long development cycles to technology and market uncertainty. Our unique integrated model is designed to directly mitigate these risks and create a more predictable path to liquidity.

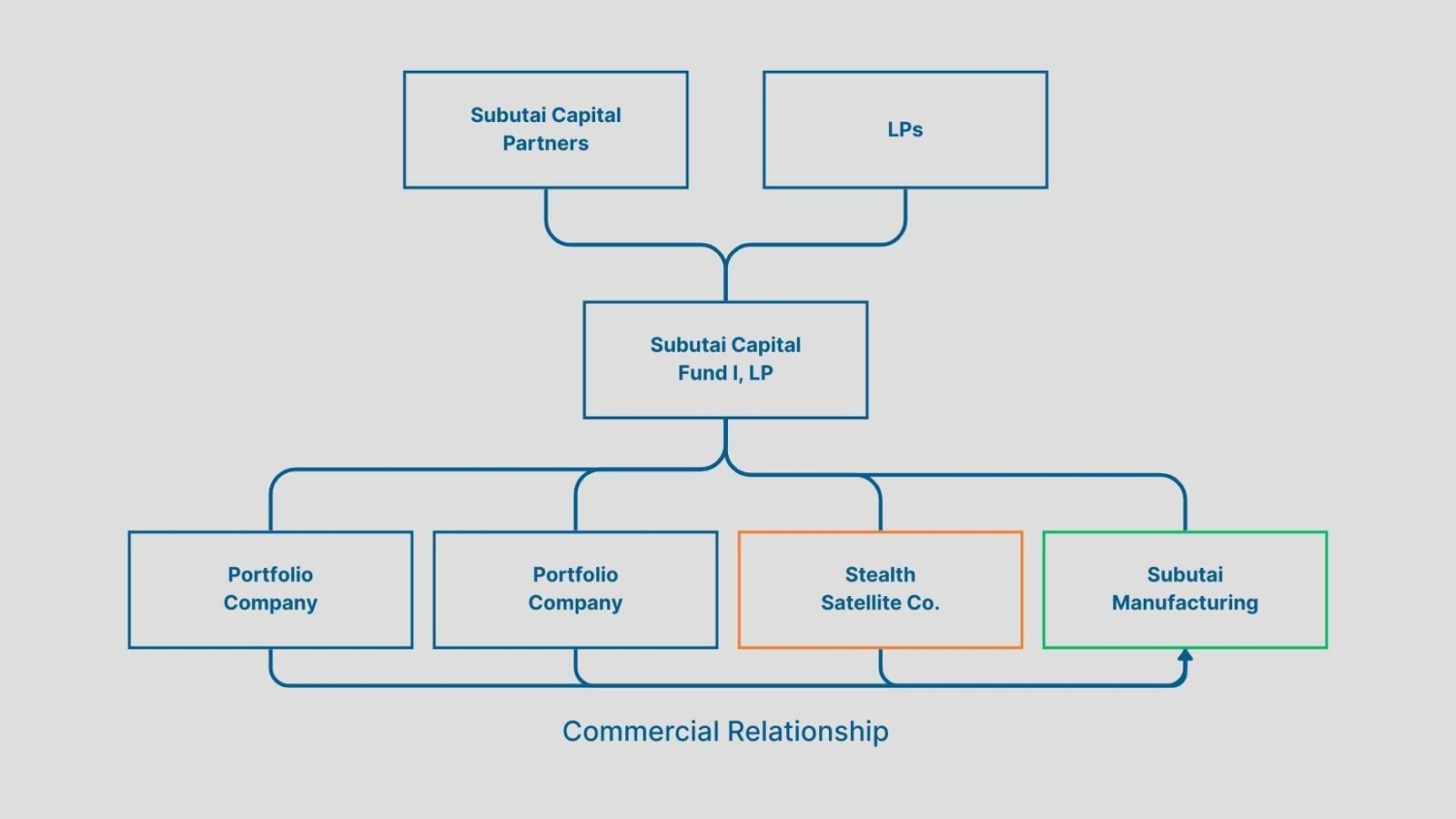

Subutai’s integrated approach combines a traditional investment fund with a strategic stake in a profitable, advanced manufacturing facility. This creates a symbiotic relationship that benefits both investors and founders:

- Mitigating Risk: Our team’s hands-on involvement and manufacturing expertise de-risk portfolio companies, reducing the likelihood of costly technical failures.

- Improving Capital Efficiency: We help companies use venture dollars more efficiently by avoiding the need for costly, in-house manufacturing infrastructure.

- Accelerating Time to Liquidity: By shortening development cycles, we bring portfolio companies to market faster, reducing the "time to exit" and enhancing your IRR.

- Building a Diversified Portfolio: You gain exposure to a curated portfolio of high-potential companies that build sustainable barriers to entry, as well as an ownership stake in a high-growth manufacturing company.